20 Recommended Reasons To Selecting AI Stock Predictions Platform Websites

20 Recommended Reasons To Selecting AI Stock Predictions Platform Websites

Blog Article

Top 10 Tips To Evaluate The Quality Of Data As Well As Sources Of Ai Trading Platforms That Predict/Analyze The Prices Of Stocks.

In order for AI-driven trading and stock prediction platforms to give accurate and reliable information, it is essential that they assess the quality of the data they use. Insufficient data could lead to incorrect predictions, loss of money, and a lack of trust. Here are the top 10 suggestions to evaluate the quality of data and the sources it comes from.

1. Verify data sources

Check where the data comes from: Be sure to use reputable and well known data providers.

Transparency. The platform must publicly disclose the sources of data it utilizes and should be able to be able to update them regularly.

Avoid single source dependency Most reliable platforms combine data from multiple sources in order to eliminate any biases.

2. Assess Data Freshness

Real-time vs. delayed data: Determine whether the platform offers actual-time data or delaying information. Real-time data is vital for active trading, while delayed data is sufficient to provide long-term analysis.

Verify the frequency of updating information (e.g. hourly minutes by minutes, daily).

Accuracy of historical data: Make sure that historical data is consistent and free of gaps or anomalies.

3. Evaluate Data Completeness

Find missing data. Examine for gaps in the historical data, ticker-less tickers, and financial statements that are not complete.

Coverage: Ensure the platform offers a broad selection of markets, stocks, indices and equities relevant to your trading strategies.

Corporate actions: Check that the platform includes stock splits (dividends), mergers, and any other corporate actions.

4. Accuracy of Test Data

Cross-verify the data: Check data on the platform against data from other sources you trust to assure that the data is consistent.

Error detection: Check for outliers, erroneous price points, or mismatched financial metrics.

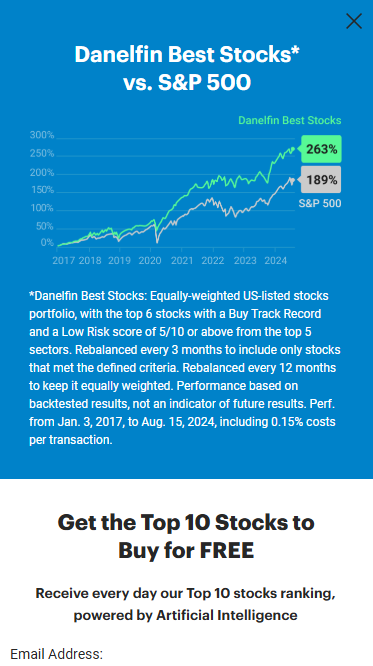

Backtesting: You may use old data to evaluate trading strategies. Verify that they are in line with your expectations.

5. Examine the Data Granularity

Level of detail: Make sure the platform has granular data, like intraday prices, volume, spreads between bid and ask, and the depth of your order book.

Financial metrics: Find out if your platform offers detailed financial reports (income statement and balance sheet) and important ratios like P/E/P/B/ROE. ).

6. Check for Data Cleansing and Preprocessing

Data normalization - Ensure that your platform is able to normalize your data (e.g. adjusts dividends or splits). This will ensure consistency.

Handling outliers (handling anomalies): Verify that the platform is handling anomalies and outliers.

Data imputation is missing Make sure to check if your platform is using reliable methods when filling in the data that is missing.

7. Evaluation of Data Consistency

Timezone alignment: Ensure that all data is aligned to the same timezone, to prevent discrepancies.

Format consistency: Ensure that data is formatted in an identical format.

Cross-market consistency: Verify that data from multiple exchanges or markets is consistent.

8. Assess Data Relevance

Relevance of your trading strategy. Check that the information corresponds to your style of trading.

Review the features available on the platform.

Review Data Security Integrity

Data encryption: Ensure the platform is encrypted to safeguard the data while it is being transmitted and stored.

Tamper-proofing: Verify that the data isn't manipulated or modified by the platform.

Conformity: Ensure that the platform you are using is compatible with all applicable laws regarding data protection (e.g. GDPR, CCPA).

10. Check out the AI model on the platform Transparency

Explainability: The system will offer insight on how AI models employ data to make predictions.

Bias detection: Check whether the platform is actively monitoring and reduces biases in the model or data.

Performance metrics: Evaluate the track record of the platform and the performance metrics (e.g. accuracy precision, recall, etc.)) to assess the reliability of its predictions.

Bonus Tips:

User feedback and reputation Review reviews of users and feedback to assess the credibility of the platform.

Trial period. You can use an unpaid demo or trial to try out the platform and its features.

Customer support: Check if the platform offers a robust customer support to assist with data-related questions.

These suggestions will allow you assess the quality of data and the sources used by AI software for stock prediction. This will enable you to make better informed decisions when trading. View the top rated inciteai.com AI stock app for site recommendations including ai for trading, ai trading, best ai stock, incite, ai for investing, trading ai, ai stock trading, chart ai trading assistant, ai for stock predictions, incite and more.

Top 10 Tips For Evaluating The Feasibility And Trial Of Ai Analysis And Stock Prediction Platforms

Prior to signing up for a long-term contract it is crucial to test the AI-powered stock prediction and trading platform to see if they suit your needs. Here are 10 top tips for evaluating each of these factors:

1. Get a Free Trial

Tips: Check if there is a trial period that allows you to try the features and performance of the system.

The reason: The trial is a great opportunity to try the platform and assess the platform without taking on any financial risk.

2. Limitations to the duration of the trial

Tip: Review the length of your trial and any limitations you may encounter (e.g. limited features, limited access to information).

The reason: Once you understand the trial constraints it is possible to determine if it is a thorough review.

3. No-Credit-Card Trials

Find trials that don't need you to provide your credit card details in advance.

Why? This will lower the chance of unexpected charges and make it easier for you to cancel your subscription.

4. Flexible Subscriptions Plans

Tips: Determine if the platform offers different subscription options (e.g. monthly, quarterly, annual) with distinct pricing tiers.

Flexible plans allow you to select the level of commitment that is most suitable to your budget and preferences.

5. Features that can be customized

Look into the platform to determine whether it lets you alter certain features such as alerts, trading strategies, or risk levels.

Why: Customization adapts the platform to meet your goals in trading.

6. Easy cancellation

Tip: Find out how easy it is to upgrade or end the subscription.

What's the reason? In allowing you to leave without hassle, you'll stay out of the wrong plan for you.

7. Money-Back Guarantee

TIP: Find platforms which offer a refund guarantee within a specified time.

What's the reason? It's an additional security step in the event your platform does not live up to the expectations you set for it.

8. Access to all features during Trial

Be sure to check that you are able to access all features included in the trial version, not just a limited edition.

Test the full functionality before making a decision.

9. Customer Support during the Trial

You can contact the customer service throughout the trial time.

Why: It is important to have dependable support so that you can solve issues and get the most out of your experience.

10. After-Trial feedback Mechanism

TIP: Determine whether you can give feedback about the platform following the test. This will assist in improving their service.

Why: A platform that valuess user feedback will be more likely to evolve so that it can meet the requirements of users.

Bonus Tip Tips for Scalability Options

Make sure that the platform you choose to use can adapt to your changing needs in trading. This means that it must have more advanced options or features when your needs expand.

Before you make any financial commitment be sure to carefully review these trial and flexibility options to decide if AI stock trading platforms and prediction are the most appropriate for you. Check out the top rated killer deal for how to use ai for stock trading for blog examples including stock predictor, ai stock prediction, ai stock prediction, ai share trading, ai copyright signals, ai options, ai stock predictions, can ai predict stock market, ai options trading, stock trading ai and more.